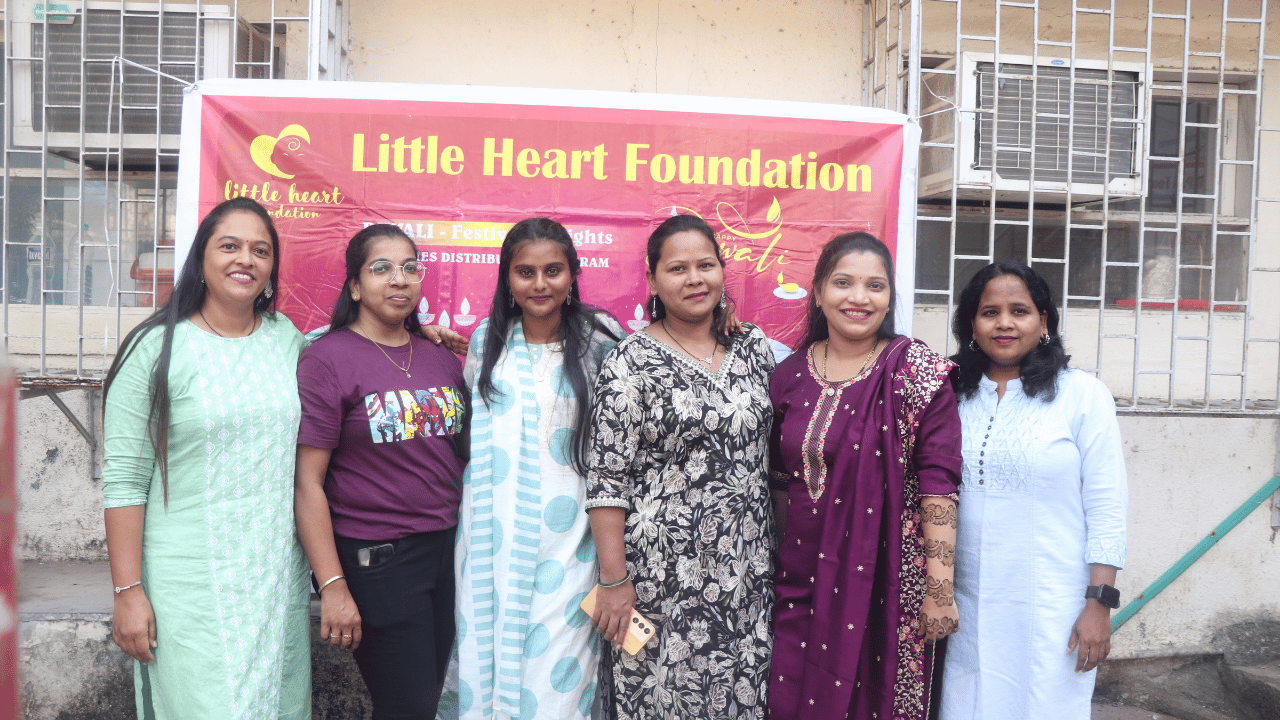

Every Child Deserves a Chance

Healthcare, nutrition, and education for little hearts

At Little Heart Foundation, we work to ensure no child is denied life-saving treatment, a healthy meal, or the right to education because of poverty. Together, we can heal hearts, fight hunger, and empower dreams.

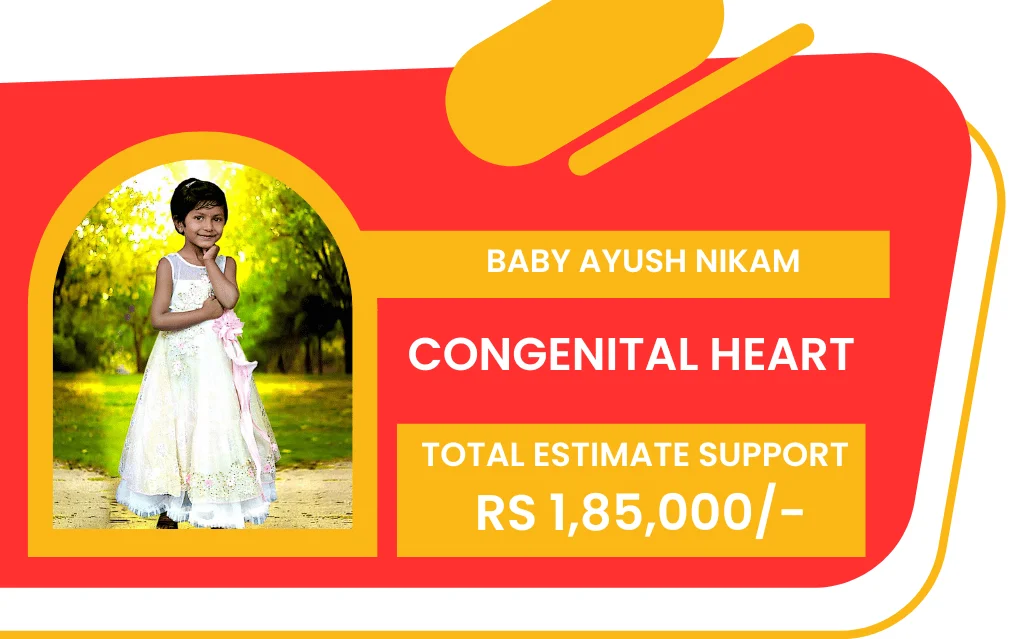

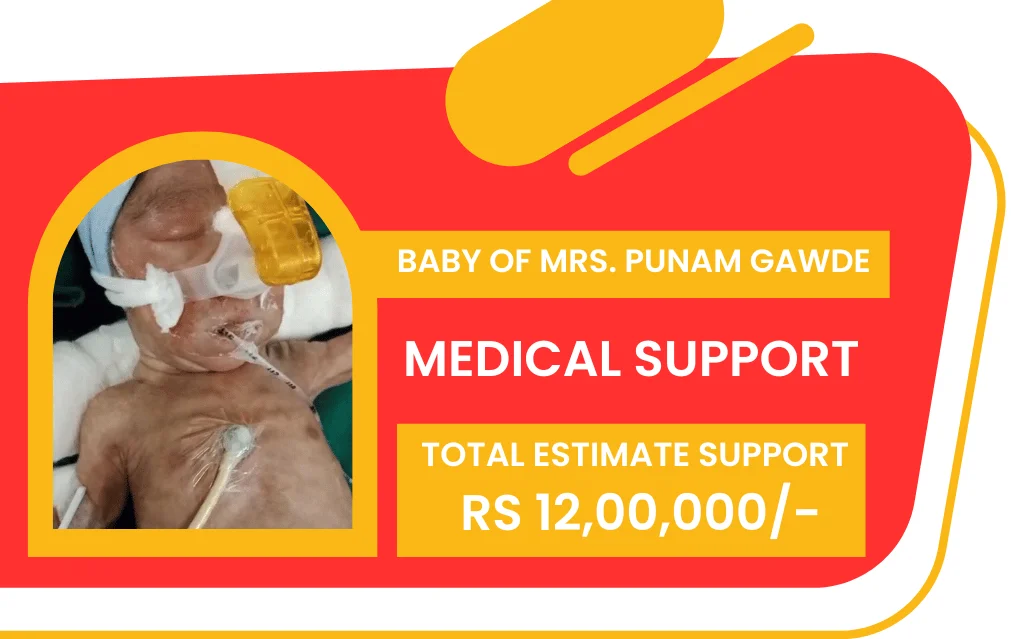

Healing Little Hearts

We provide critical medical support to children battling life-threatening conditions, ensuring every child gets the care and chance to live they deserve.

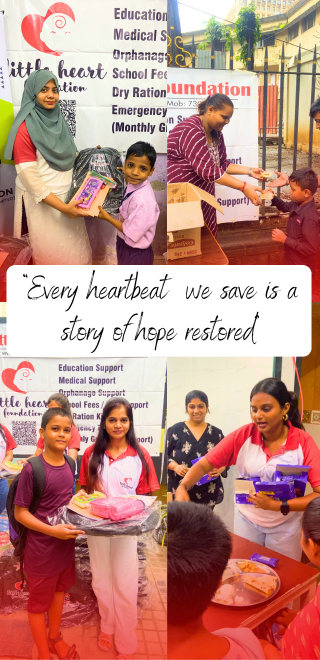

Nourishing Bodies

Through nutrition and education programs, we fight hunger and keep children in school—helping them grow healthy, confident, and full of hope.