Healthy Bodies, Bright Minds

Fulfill A Wish For A Child In Need

When you give to our Wish List, you help to fulfill the wishes of children in need for brand-new clothes and shoes.

Whether you choose to support one child or many, these are the kids who need your help the most – Children’s belongings to underprivileged families or daily wages labourers

Clothing and Shoes

Coats, jackets, winter clothing, shoes, socks, and other basic necessities.

School Supplies

Backpacks, notebooks, pens, pencils, and other items needed for school.

Toys and Games

Books, puzzles, board games, and other items for entertainment and learning.

Household Items

Cleaning supplies, toiletries, and other items needed for daily living.

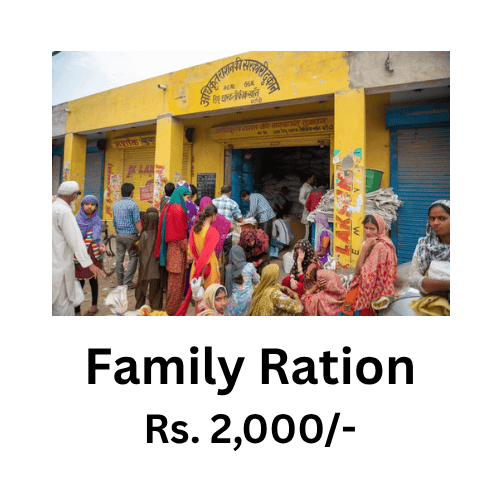

A plate of food may seem small, but to a hungry child it is strength, dignity, and the courage to dream. Feed a child today, and you change a life forever.

Recent Donors:

Sajjid Z Chinoy

March 2, 2026

Sayali Khambekar

March 2, 2026

KAUSHAL

March 2, 2026

Sai Chaitanya

March 2, 2026

Brijesh Vishwakarma

March 1, 2026

Deepak pareek

March 1, 2026

lokendra

March 1, 2026

Vivek

March 1, 2026

Sunny Patil

March 1, 2026

Afzal sultan saifi

March 1, 2026

Sajja

March 1, 2026

Nampally Gautam Varma

February 28, 2026

Updates

We will share recent updates and progress of this campaign here. Stay tuned for the latest developments and success stories.