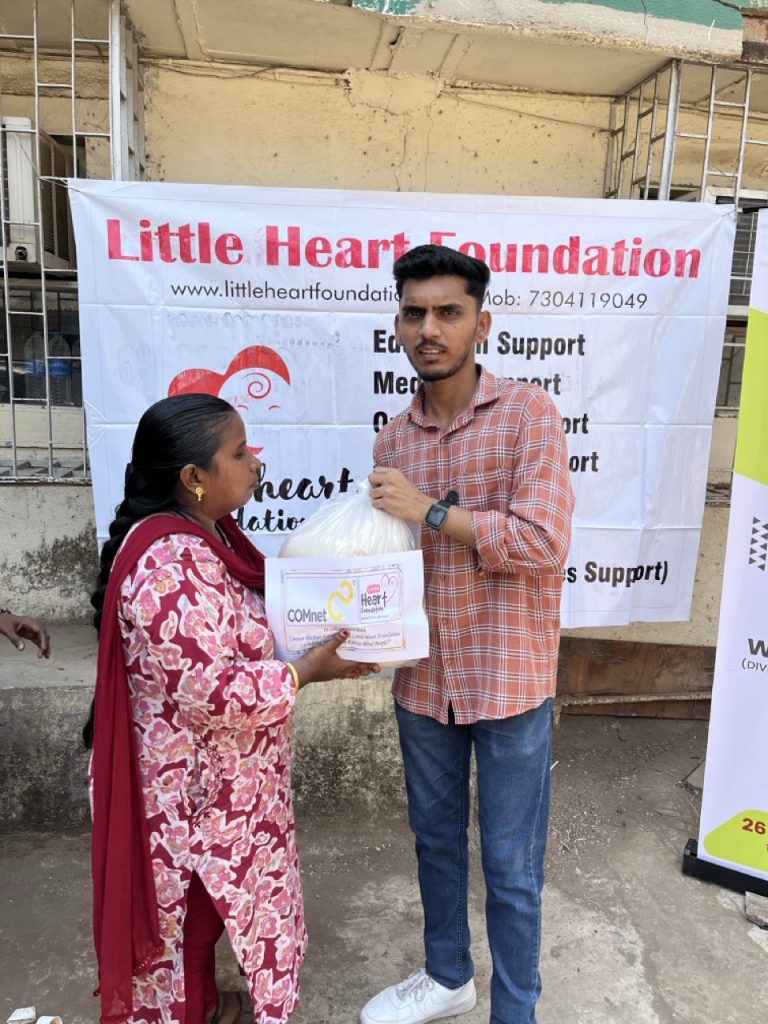

Every month Wish List Program

An “underprivileged wish list program” is a charitable initiative where individuals or organizations create lists of needed items for underprivileged children or families, which are then shared with potential donors who can fulfill those wishes.

About the Campaign

Fulfill A Wish For A Child In Need

When you give to our Wish List, you help to fulfill the wishes of children in need for brand-new clothes and shoes.

Whether you choose to support one child or many, these are the kids who need your help the most – Children’s belongings to underprivileged families or daily wages labourers

Examples of Items on Wish Lists:

Clothing and Shoes: Coats, jackets, winter clothing, shoes, socks, and other basic necessities.

School Supplies: Backpacks, notebooks, pens, pencils, and other items needed for school.

Toys and Games: Books, puzzles, board games, and other items for entertainment and learning.

Household Items: Cleaning supplies, toiletries, and other items needed for daily living.

Food and Groceries: Non-perishable food items, gift cards for groceries, and other items to help families with food security.

Other Needs: Medical supplies, diapers, and other items depending on the specific needs of the children and families.

About Little Heart Foundation

Little Heart Foundation is a not-for-profit organisation headquartered in Thane, Maharashtra. The Foundation provides nutritious meals to children studying in Government schools and Government-aided schools. Little Heart Foundation also aims to counter malnutrition and support right to education of children’s.

Cities

Partner Hospitals

Kids Supported

Why contribute to our Programme?

Your contribution is more than just a donation—it’s an investment in hope, opportunity, and transformation. By supporting our programme, you:

- Empower Children: Provide access to education and skills that open doors to brighter futures.

- Improve Lives: Ensure children receive essential healthcare and nutrition for a healthier tomorrow.

- Build Communities: Strengthen local communities by fostering sustainable development and self-reliance.

- Be the Change: Join a growing movement of changemakers committed to making the world a better place.

Improve life of others

FREQUENTLY ASKED QUESTIONS

As per the revised tax exemption act, effective April 1, 2017, When you make donations above ₹500 to Little Heart Foundation, your donation amount will be eligible for 50% tax exemption under Section 80G of Income Tax Act. The exemption is calculated by reducing the donated amount from your taxable salary. For instance, /example, if your taxable income per year is ₹2,00,000 and you make a donation of ₹5,000 then your net taxable income will become ₹197,500. Your tax will now be calculated on this new amount basis the prevailing tax rates.

A minimum of ₹500 needs to be donated to avail tax exemption under IT sec 80 G. However, cash donations above ₹2,000 are not applicable for 80G certificates.

We generate the tax certificate within 3 days from the date of contribution made through online donations. Including the courier process, it takes 7 days for the exemption certificate to reach you. If you contribute offline it takes 7 to 10 days. However, we may not be able to provide you a duplicate receipt. But we can send you the Income Tax Exemption certificate copy.