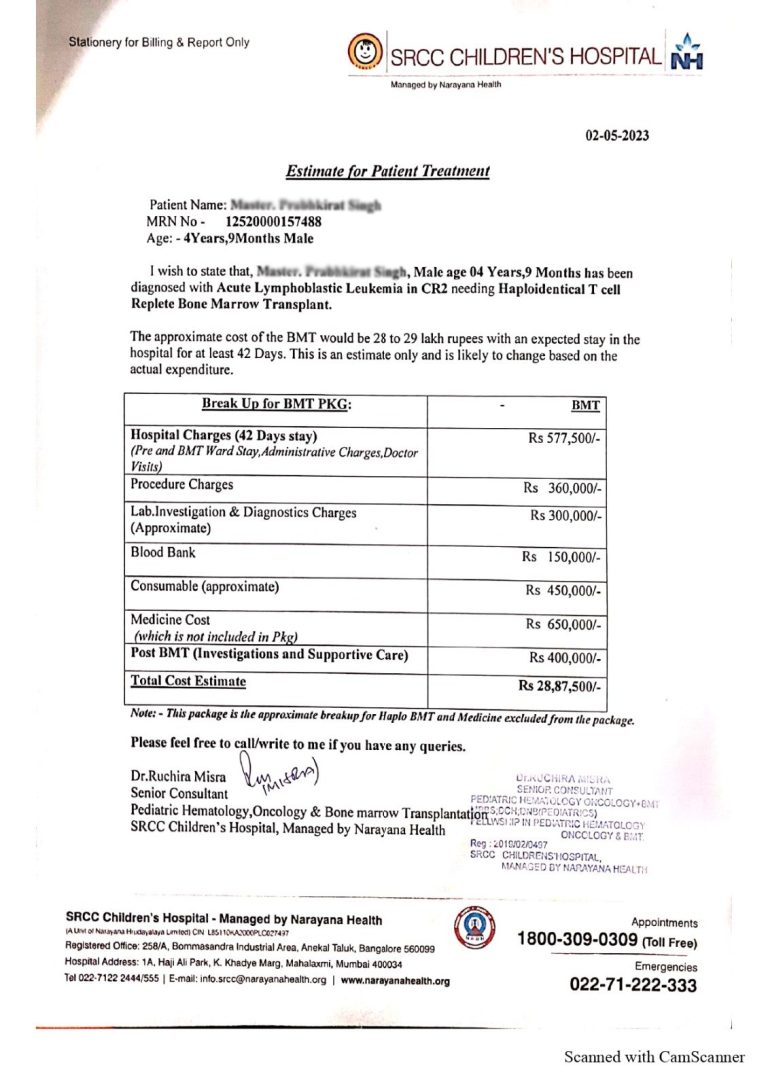

My name is Satindar Singh and I work as a recovery executive and am trying to raise funds for my son, Prabhkirat Singh who is suffering from Acute lymphoblastic Leukemia (all) and is undergoing treatment at S.R.C.C. Hospital in Mahalaxmi.

My son needs to undergo Bone Marrow Transplant. Also the family has done all it can to collect the total amount required for the treatment but Rs.21,00,000/- more is required. As the amount required is huge along with the duration of treatment I request you to kindly contribute towards the treatment and help during this time of need. Each contribution is important! Please help us raise this amount by clicking on the donate button and sharing this page with your friends and family.

We are grateful for your help and wishes.

Thank you.

While donating through Little Heart Foundation you are eligible to claim tax exemption under section 80G of Income Tax Act, 1961.

All Offline / Online Donations are Tax deductible under section 80G.