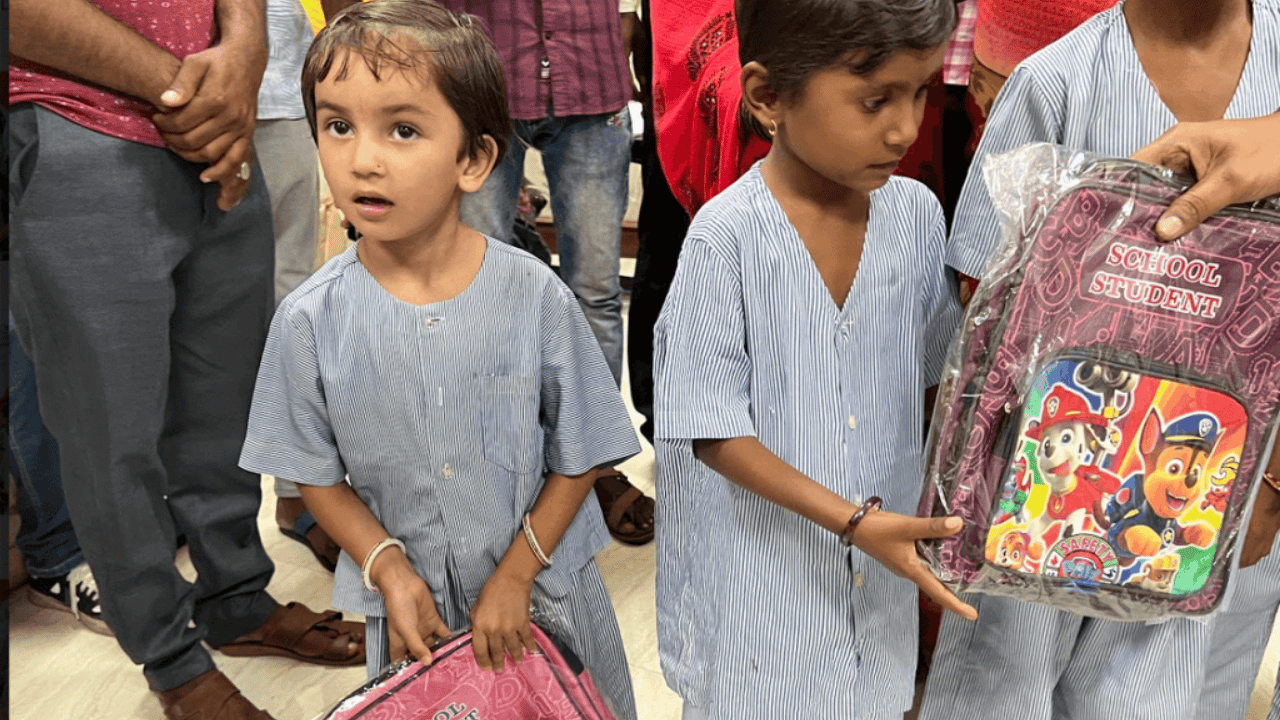

A Home of Hope for Every Child

Situated in Thane West, Nanhi Pari Foundation works tirelessly for underprivileged children — orphaned, abandoned, destitute, and those from vulnerable backgrounds. Our mission is simple yet profound: to give every child a fair chance at life.

Currently, we support 250 children 150 boys and 100 girls between the ages of 5 and 15 providing them shelter, education, nutrition, and emotional care. Each child here is a story of resilience waiting to be rewritten through compassion and opportunity.

A Childhood They Deserve

Homeless and street children often grow up without the basic joys that most of us take for granted — a meal, a bed, safety, and the warmth of care. Their lives are marked by uncertainty and struggle, not play and laughter. This Christmas, we invite you to see the world through their eyes — children who deserve the same sparkle, joy, and innocence as any other child.

Be Their Santa, Be Their Smile

What does Christmas mean to a child without a family or food? It means hope. It means kindness taking the form of a meal, a gift, or a moment of happiness. By becoming a child’s Santa, you give more than just a plate of food — you gift them the feeling of being seen, loved, and valued. Every donation fills a stomach, but also a heart.

Your Kindness Can Change a Life

When you donate a meal, you are not just feeding hunger — you are nurturing futures. Each contribution helps us serve nutritious meals, provide school kits, and keep children healthy and happy. Your support ensures that no child sleeps hungry or dreams of food instead of their future. Join hands with us to bring smiles, safety, and strength to every child. Because when you feed a child, you feed hope itself.

Household Items

Cleaning supplies, toiletries, and other items needed for daily living.

A plate of food may seem small, but to a hungry child it is strength, dignity, and the courage to dream. Feed a child today, and you change a life forever.

Recent Donors:

Edward Anthony

February 20, 2026

Edward Anthony

February 20, 2026

Amit

February 20, 2026

Tanmoy

February 20, 2026

Haridasan

February 20, 2026

Sajjid Z Chinoy

February 19, 2026

Rohit

February 19, 2026

Anand

February 18, 2026

Anand

February 18, 2026

Suyog Patil

February 18, 2026

Laxmikant Deshmukh

February 17, 2026

SASWATA

February 17, 2026

Updates

We will share recent updates and progress of this campaign here. Stay tuned for the latest developments and success stories.