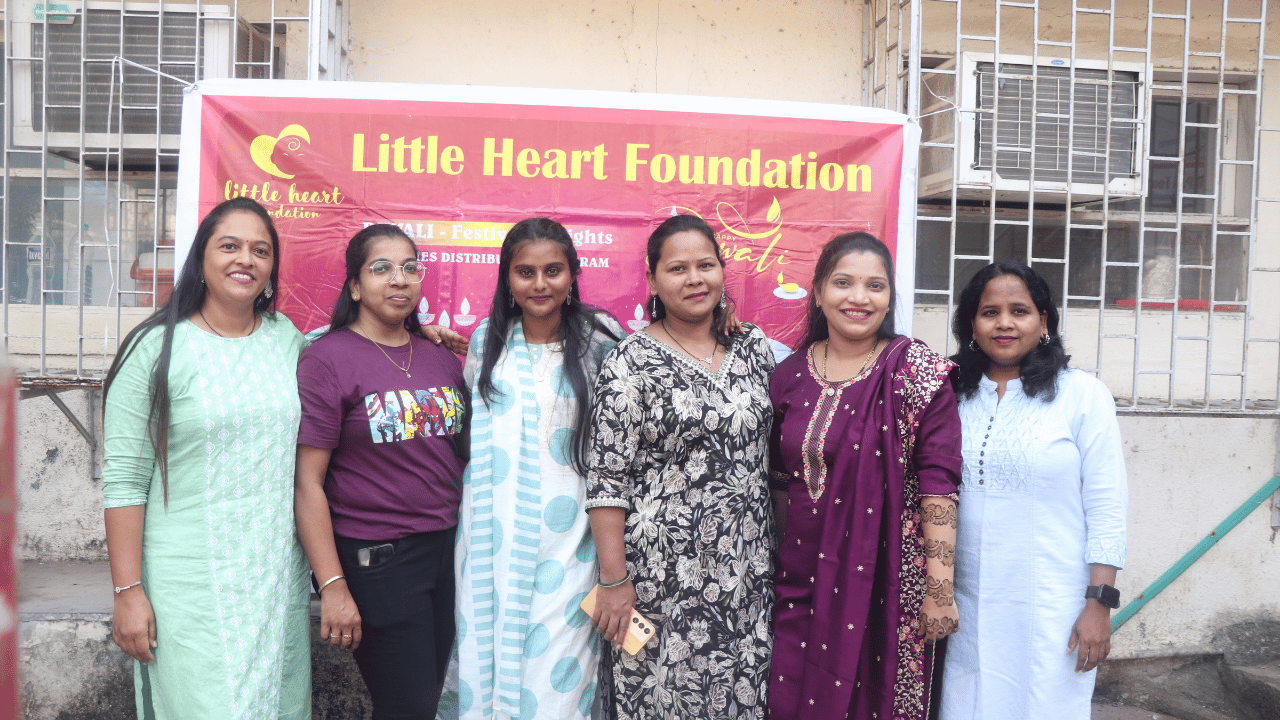

Join the Movement of Light

This Diwali, let’s make our celebration inclusive. Be the reason someone smiles, eats well, and sleeps peacefully. Support the cause, volunteer your time, or contribute to provide festive essentials to families in need. Together, we can ensure that the light of Diwali reaches every doorstep, and every heart shines with hope.

The Festival of Light and Love

Diwali is more than a celebration of lights — it is a reminder that even the smallest spark can brighten countless lives. Beyond the diyas and decorations lies the deeper essence of Diwali: sharing joy, spreading love, and lifting others from darkness into hope.

The True Spirit of Giving

This festive season, let us celebrate generosity — not with grandeur, but with compassion. When we reach out to those who have less, Diwali becomes more meaningful. The true glow of this festival doesn’t come from lamps alone but from the warmth of human kindness that lights up hearts.

Together, We Can Spread Smiles

Thousands of underprivileged families struggle to experience the joy we often take for granted. With your help, we can change that. Sharing sweets, donating food, or gifting basic necessities can turn an ordinary evening into a moment of celebration for them. One thoughtful act can create a festival of happiness in every home.

A Small Gift, A Big Difference

Even the simplest gestures — a box of sweets, a bag of groceries, or new clothes for a child carry the power to transform someone’s Diwali. These small offerings tell them they are not forgotten, that compassion still connects us all. Your kindness can make the world a little brighter, one family at a time.

A plate of food may seem small, but to a hungry child it is strength, dignity, and the courage to dream. Feed a child today, and you change a life forever.

Recent Donors:

Sajjid Z Chinoy

March 2, 2026

Sayali Khambekar

March 2, 2026

KAUSHAL

March 2, 2026

Sai Chaitanya

March 2, 2026

Brijesh Vishwakarma

March 1, 2026

Deepak pareek

March 1, 2026

lokendra

March 1, 2026

Vivek

March 1, 2026

Sunny Patil

March 1, 2026

Afzal sultan saifi

March 1, 2026

Sajja

March 1, 2026

Nampally Gautam Varma

February 28, 2026

Updates

We will share recent updates and progress of this campaign here. Stay tuned for the latest developments and success stories.